It can be difficult to expand an online business to new markets, particularly if you have to navigate the intricate issues regarding VAT registration, filings for VAT and extended producer responsibility (EPR). However, with the right tools and the right support this process can be considerably more manageable. Staxxer is a complete solution that is a one stop shop for all your VAT and EPR requirements. This ensures seamless and effective operations throughout Europe for online sellers.

VAT Compliance The Herausforderungs

Value Added Tax (VAT) Compliance with VAT is an essential element of running an e-commerce business in Europe. Every country has different VAT regulations. In order to remain in compliance, you need to pay at every little detail. E-commerce companies must register for VAT in each market they sell into and submit regular returns of VAT, and guarantee a precise calculation of the due VAT. This can take a long time, is prone to mistakes and diverts important resources away from other activities.

Staxxer: A one-stop shop to find VAT Compliance

Staxxer simplifies VAT compliance through providing an all-in-one solution to VAT registration as well as VAT filing. Staxxer streamlines these processes to let e-commerce companies concentrate on expansion and growth, without having to worry about administrative burdens that drag them down. Here’s how Staxxer helps to make VAT compliance simple:

Automated VAT registration. To expand into a new country, you must register for VAT in the specific country. Staxxer manages the entire registration process. This ensures the compliance with local laws, and removes the need to help businesses navigate complicated bureaucratic procedures.

Efficiency of VAT Files: Businesses that operate in Europe must make VAT filings on a regular basis. Staxxer’s software automates VAT filings, ensuring timely and accurate submissions. The platform integrates with all channels of sales and consolidates data to calculate VAT for every country, down to the very last penny.

Staxxer offers a full VAT management service, ranging from calculating VAT through to managing declarations. This end-to-end management ensures that companies are compliant without dedicating significant time and resources for VAT-related tasks.

Role extended producer responsibility for the role

Extended Producer Responsibility (EPR) is an environmental policy approach that holds producers accountable for the whole lifespan of their products, including disposal and recycling. This means that e-commerce companies must abide by regulations related to packaging wastes, electronic wastes, and other particular waste streams that relate to products.

Staxxer’s EPR Solutions

Staxxer provides its expertise in this particular area, too. Staxxer can assist businesses in meeting their EPR obligations.

Automated EPR Compliance Staxxer’s platform integrates EPR Compliance within its services by automating reporting and managing the waste obligation. It makes sure that businesses are in compliance with environmental regulations without imposing additional administrative burden.

EPR requires detailed reports on the different types of waste as well as their quantity. Staxxer software makes the process easier by consolidating and producing accurate reporting, which ensures the compliance with both local and international regulations.

Sustainable Business Practices Through tackling EPR obligations in a timely manner, businesses can enhance their sustainability efforts. Staxxer’s solutions assist businesses in reducing their impact on the environment, and promote environmentally responsible production and disposal methods.

Why Entrepreneurs Choose Staxxer

Staxxer is a full-featured automated tool that makes compliance with EPR and VAT for entrepreneurs as well as e-commerce companies. Here are a few benefits.

Automatizing VAT filings, EPR compliance and other administrative tasks can save businesses time and allow them to focus on growth and expansion. Staxxer solutions remove the need for manual information input and administrative tasks.

Accurate Calculations: Staxxer’s platform guarantees exact calculations of the VAT due in each country, minimizing the risk of errors and penalties. The accuracy of the software is vital to ensure compliance and avoid costly errors.

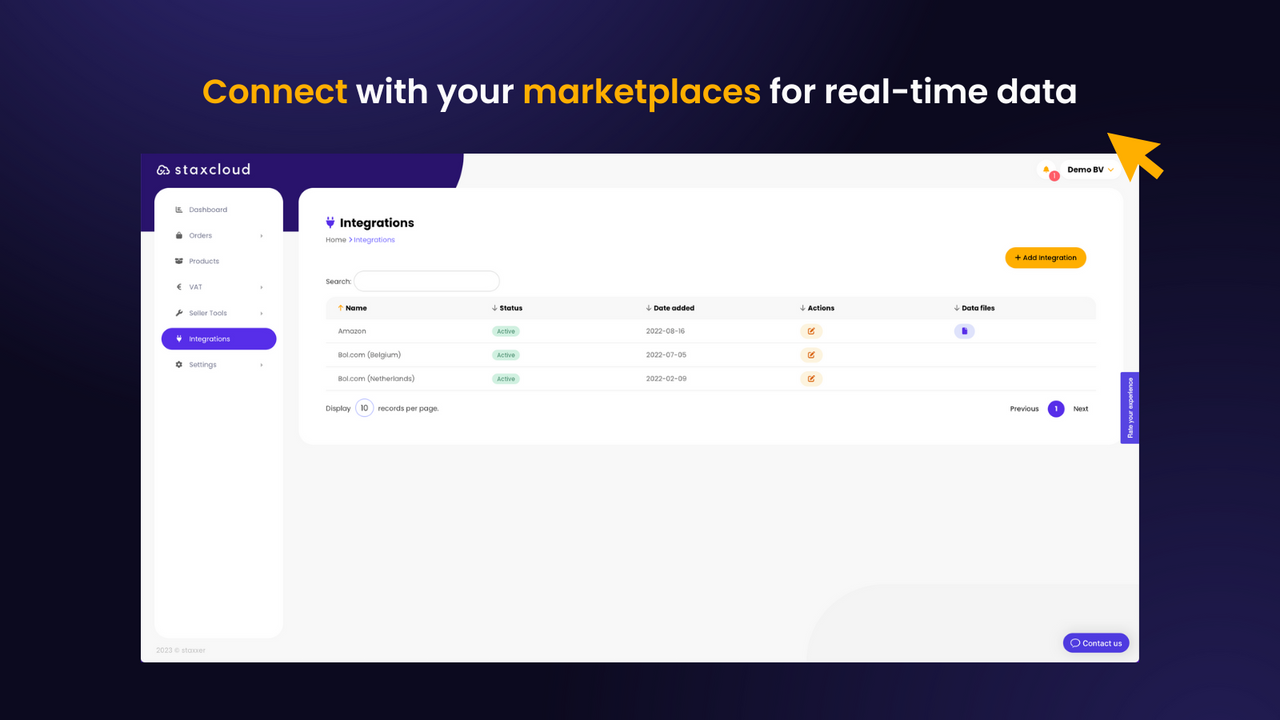

Staxxer is easy to operate. Its user-friendly interface, seamless integration with different channels of sales, and its intuitive layout make it easy for companies of all sizes to fulfill their VAT and EPR obligations. The user-friendly platform design streamlines complex procedures and helps make compliance easy.

Staxxer can help businesses operate without fear, knowing that they’re compliant to all applicable regulations. Entrepreneurs who want to expand without having to worry about the regulations will find this security invaluable.

Also, you can read our conclusion.

Staxxer is a one-stop-shop for businesses seeking to streamline their compliance with EPR and VAT. By automating VAT registration, VAT filings and EPR filings, Staxxer allows businesses to focus on growth and expansion. Staxxer’s extensive platform guarantees precise calculation, prompt submission, and long-term sustainability and makes it a perfect option for entrepreneurs who wish to grow without hassle. Explore Staxxer’s offerings and discover how simple compliance can be.